Ethena (ENA) price remains steady at a critical support level, with investors eyeing the potential breakout opportunity at $1.40

ENA Coin Price: Market Sentiment Rebounds

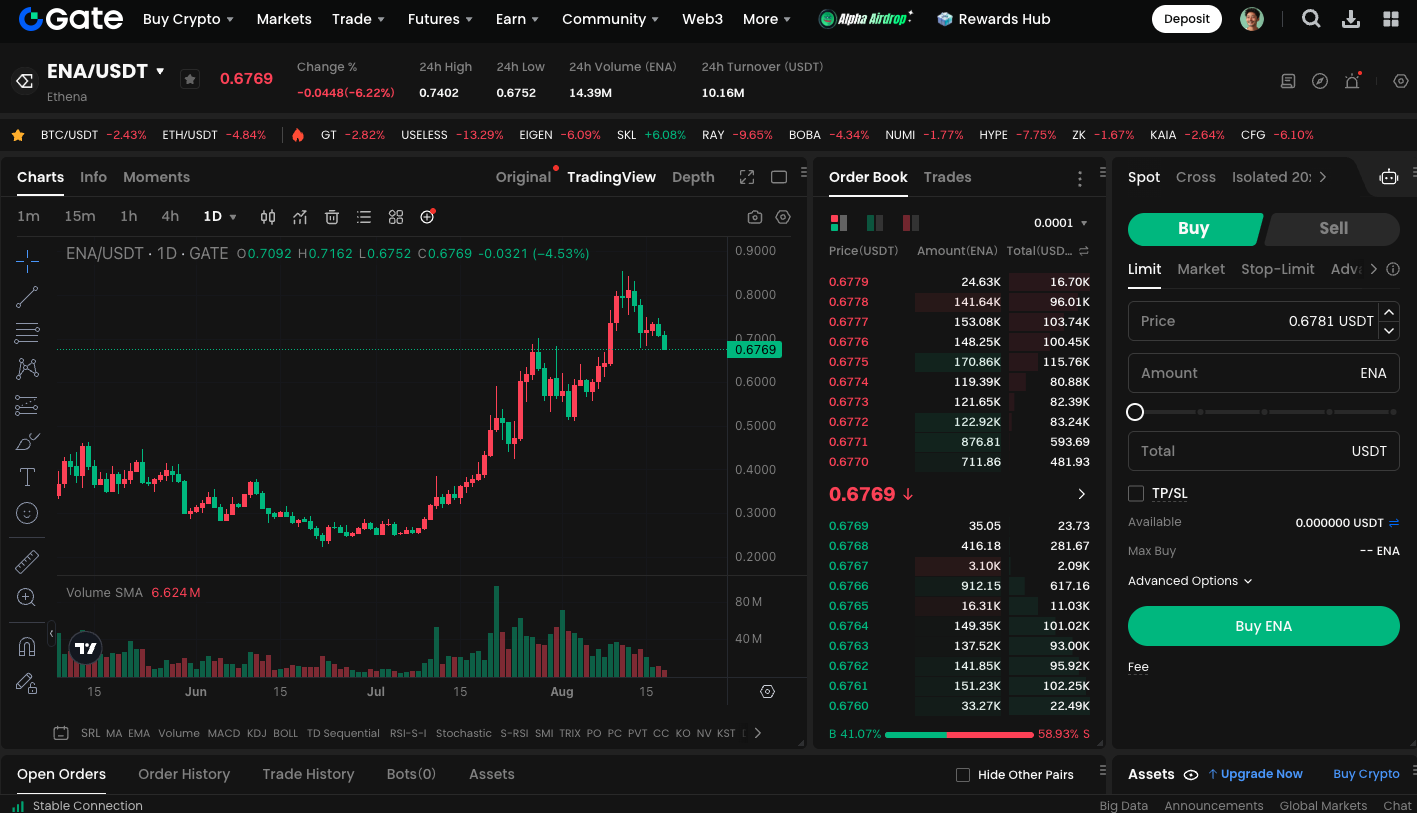

In the midst of recent volatility in the crypto market, Ethena (ENA) has shown strong downside resistance, with ENA coin price holding steady at around $0.7. This stable range has become a key focus for investors, and many see this consolidation as a potential launchpad for a new upward trend.

ENA Technical Outlook

Short-term technical analysis highlights $0.67–$0.64 as major support, with resistance between $0.75 and $0.8. Should ENA break above this resistance, the price could advance to the $1–$1.4 range, sparking a larger bullish move. If support fails, a temporary pullback may occur; however, the overall market structure remains bullish.

DeFi Applications Fuel Demand

Ethena’s value proposition extends beyond technical indicators. Its flagship product USDe (synthetic dollar) and staking rewards continue to attract users. These features drive increased Total Value Locked (TVL) across its ecosystem. These strong fundamentals give ENA a competitive edge in DeFi, especially compared to other DeFi projects experiencing declining liquidity.

Bullish Momentum Builds

Analysts widely agree that ENA’s current stability lays a strong foundation for further gains. With growing interest in the DeFi sector, many analysts consider ENA a potential outperformer, possibly emerging as a leading token in the next phase.

Token Unlock May Spark Short-Term Volatility

Ethena plans to unlock more than 40 million tokens on September 2, 2025, representing approximately 0.64% of circulating supply. If early holders sell post-unlock, short-term pressure may affect the ENA coin price. However, many in the market believe this event is already priced in by investors, so its impact could be limited.

You can trade ENA spot here: https://www.gate.com/trade/ENA_USDT

Summary

ENA currently benefits from both establishing a technical bottom and strong fundamentals. If it maintains support at $0.67–$0.64 and breaks through the $0.75–$0.8 resistance, ENA coin price could challenge $1.4 or higher. While the upcoming token unlock might introduce volatility, the long-term outlook remains positive.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025