What is KernelDAO (KERNEL)?

What is KernelDAO?

(Source: kernel_dao)

In the current narrative of Restaking in the crypto world, KernelDAO is swiftly entering the battlefield, not only building a Restaking model on ETH but also pioneering a new layout of BNB version EigenLayer, attempting to unleash the potential of the three major assets ETH, BTC, and BNB at once. KernelDAO is not a single protocol, but a powerful Restaking infrastructure and product portfolio, currently mainly composed of three core products:

- Kernel: Native Restaking solution on BNB chain

- Kelp: A Liquid Restaking protocol for ETH, launching the token rsETH

- Gain: One-click access to the asset insurance vaults for high-quality airdrops and profit opportunities

KernelDAO's Restaking Super Network

1. Kernel: The decentralized security engine of the BNB chain

Kernel is a Restaking protocol built on the BNB Chain, focusing on bringing additional economic security and development flexibility to the BNB chain. This module not only provides decentralized validators and re-staking mechanisms for BNB, but also gradually becomes a fundamental security source for multiple applications and middleware.

- Has attracted over 20 projects to settle in for construction

- Continuing the secure architecture validated through practical combat of BNB Chain

- Provide integrated tools and development frameworks tailored for developers

These features make Kernel a potential modular security layer for the BNB Chain, driving more innovative DeFi, GameFi, and social protocols to develop rapidly on it.

2. Kelp: Liquidity solution for ETH Restaking

Kelp is a Liquid Restaking protocol designed specifically for Ethereum. Users can restake ETH to receive tokenized assets rsETH, which can be used for providing liquidity, yield farming, and protocol governance in over 50 DeFi protocols. Kelp's core advantage lies in enabling ETH assets to have three sources of income simultaneously:

- Original ETH Staking Rewards

- Protocol rewards driven by Restaking

- rsETH brings additional rewards to DeFi asset circulation

This multi-income structure is a major weapon for Kelp to seize the LRT market.

3. Gain: User-friendly one-click revenue entry

Gain is an asset treasury module designed for airdrops and yield players under KernelDAO, which integrates the pledging of multiple potential protocols, Airdrop eligibility, and strategies into a simple entry point, allowing users to complete complex configurations with a single button:

- Integrated airdrop navigation with high-yield opportunities

- Suitable for ETH and rsETH liquidity assets

- Capture potential rewards without the need for complicated operations

This is not just a functional innovation, but also a design concept that lowers the threshold and strengthens the user's sense of participation.

KernelDAO's Restaking ecosystem

KernelDAO's ambition goes beyond single-chain Restaking, extending its model to cross-chain infrastructure. In addition to establishing dual cores on ETH and BNB, it is currently experimenting with the yield release and re-staking mechanism of BTC assets, making KernelDAO a convergence point for the three major assets ETH, BNB, and BTC. More importantly, these Restaking mechanisms not only provide economic security but also give rise to a whole new set of DeFi infrastructure, including:

- Yield tokenization platforms (such as Pendle)

- Margin Lending Market

- Highly composable DeFi middleware applications

The openness of this financial combination makes KernelDAO not just a single protocol, but a stackable, scalable, and evolving financial protocol matrix.

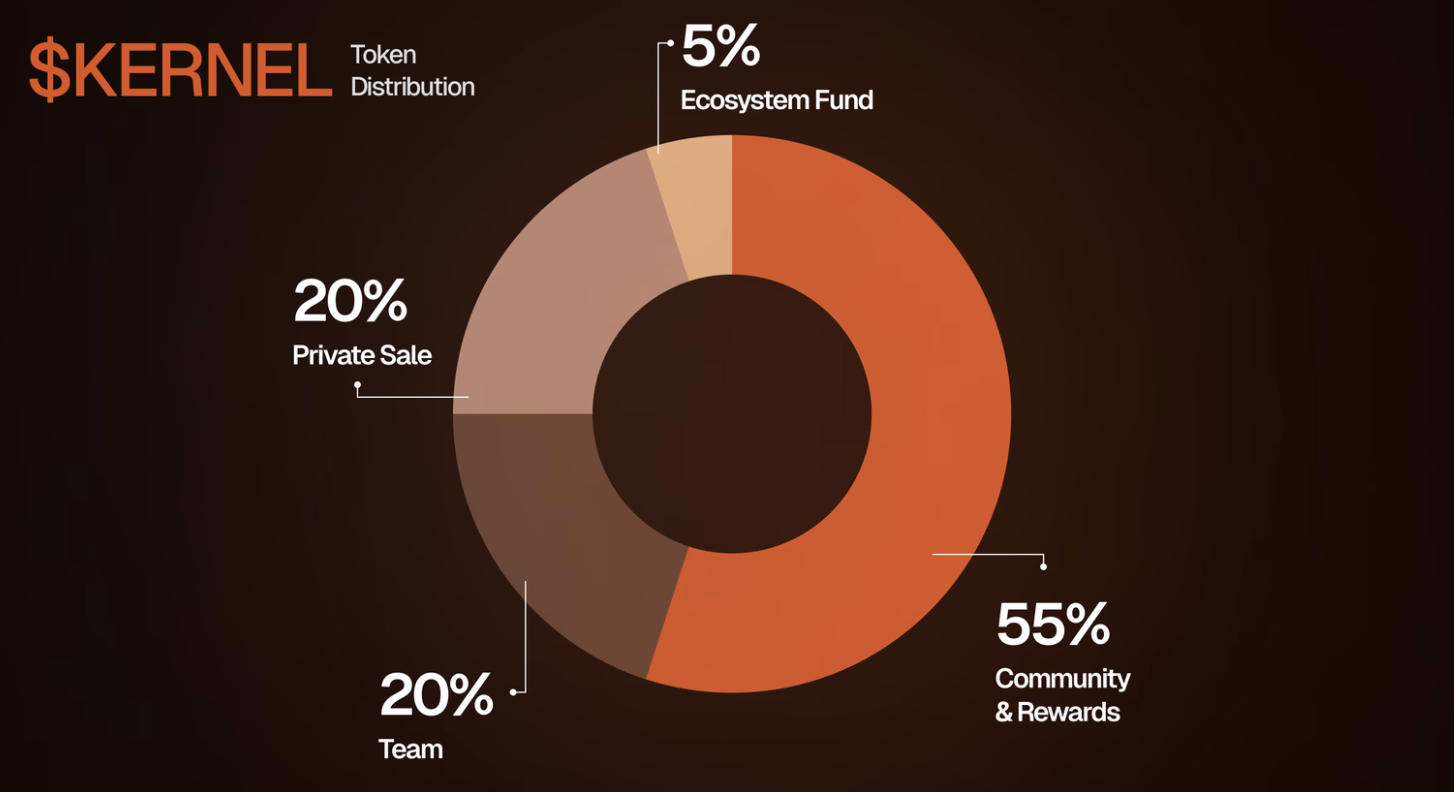

The token economics of KernelDAO

$KERNEL is the unified governance token for all products in the KernelDAO ecosystem, spanning the three major modules of Kelp, Kernel, and Gain. Its design focuses on community first, long-term incentives, combining governance rights with various use cases. The total supply of $KERNEL is 1 billion tokens, and the distribution model emphasizes community participation and long-term sustainability. The specific allocation ratios and design ideas are as follows:

1. Community rewards and airdrops: 55%

- Airdrop (20%): Targeted at early participants and strategic task completers

- Future Rewards (35%): Used for liquidity mining, Restaking incentives, community contributions, etc.

2. Private Placement Round: 20%

- Including completed and future possible private placement funds, lock-up for 12 months after TGE, with an unlocking period of 18 months

- Team and Advisors: 20%

- For core development and strategic advisor incentives, there is also a 12-month lock-up + 36-month linear unlock.

3. Ecosystem and Partners: 5%

- Market making, partnership agreements, and on-chain liquidity allocation reserve quota

(Source: kerneldao)

KernelDAO allocates 75% of tokens to the community and development foundation, demonstrating its strong commitment to open governance and user orientation.

Core Features

- Governance participation: holders can vote to participate in protocol upgrades, parameter adjustments, and resource allocation

- Restaking support: can be used to support intermediary software and applications in the entire ecosystem

- Liquidity provision: Providing liquidity in AMM can earn additional rewards and mining income

- Ecosystem Participation Rewards: You can receive airdrops from partner projects and other protocol incentives.

This design aims to deeply bind token holders with the entire KernelDAO ecosystem and involve them in making collective decisions about the future direction.

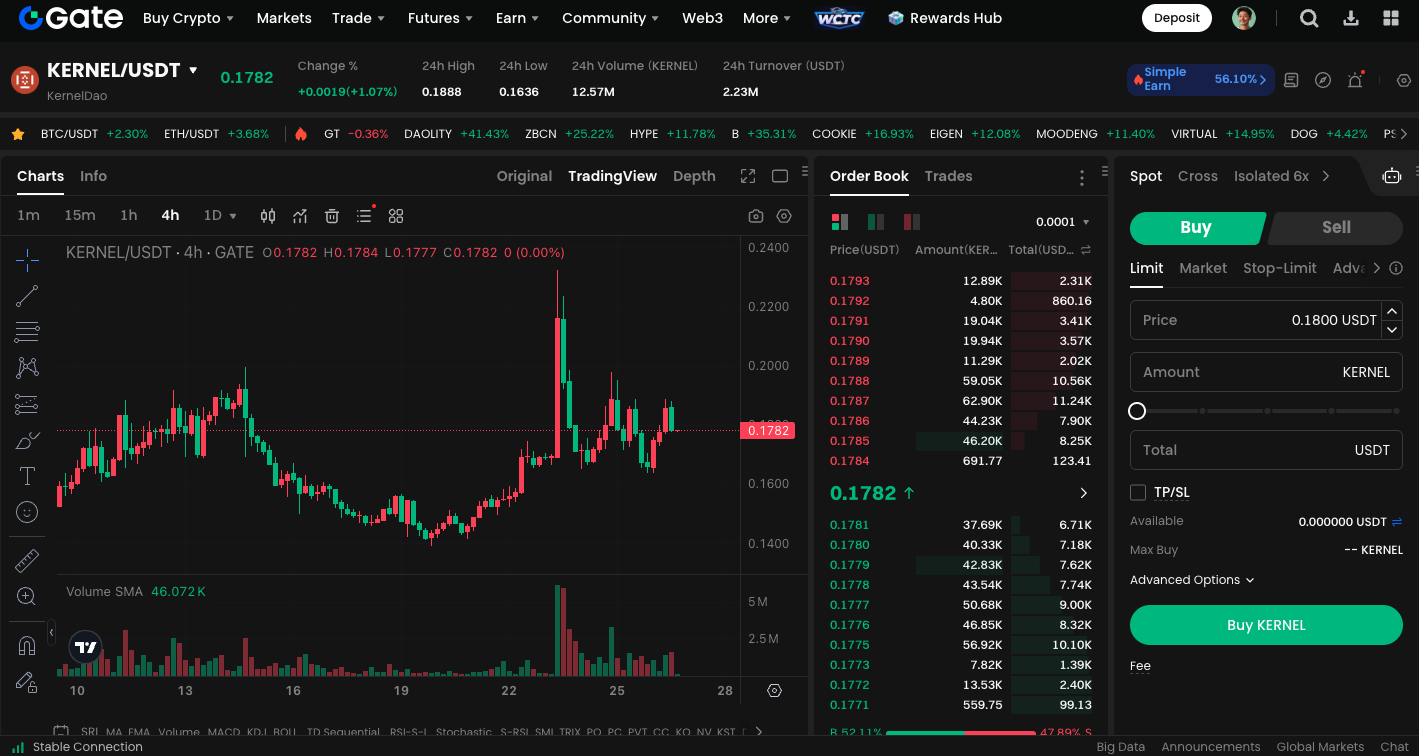

Start KERNEL spot trading now:https://www.gate.com/trade/KERNEL_USDT

Summary

At the time when Restaking officially enters the era of multi-chain competition, KernelDAO is one of the few protocols that incorporates BNB into its core design and implements multiple products. It is not just a simple Liquid Restaking, but an attempt to create a comprehensive financial network including: BNB native security engine, ETH liquidity re-staking assets, one-stop airdrops and revenue entry, and an open token economy and governance structure.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025