MileHashCat

Qyugn521

MileHashCat

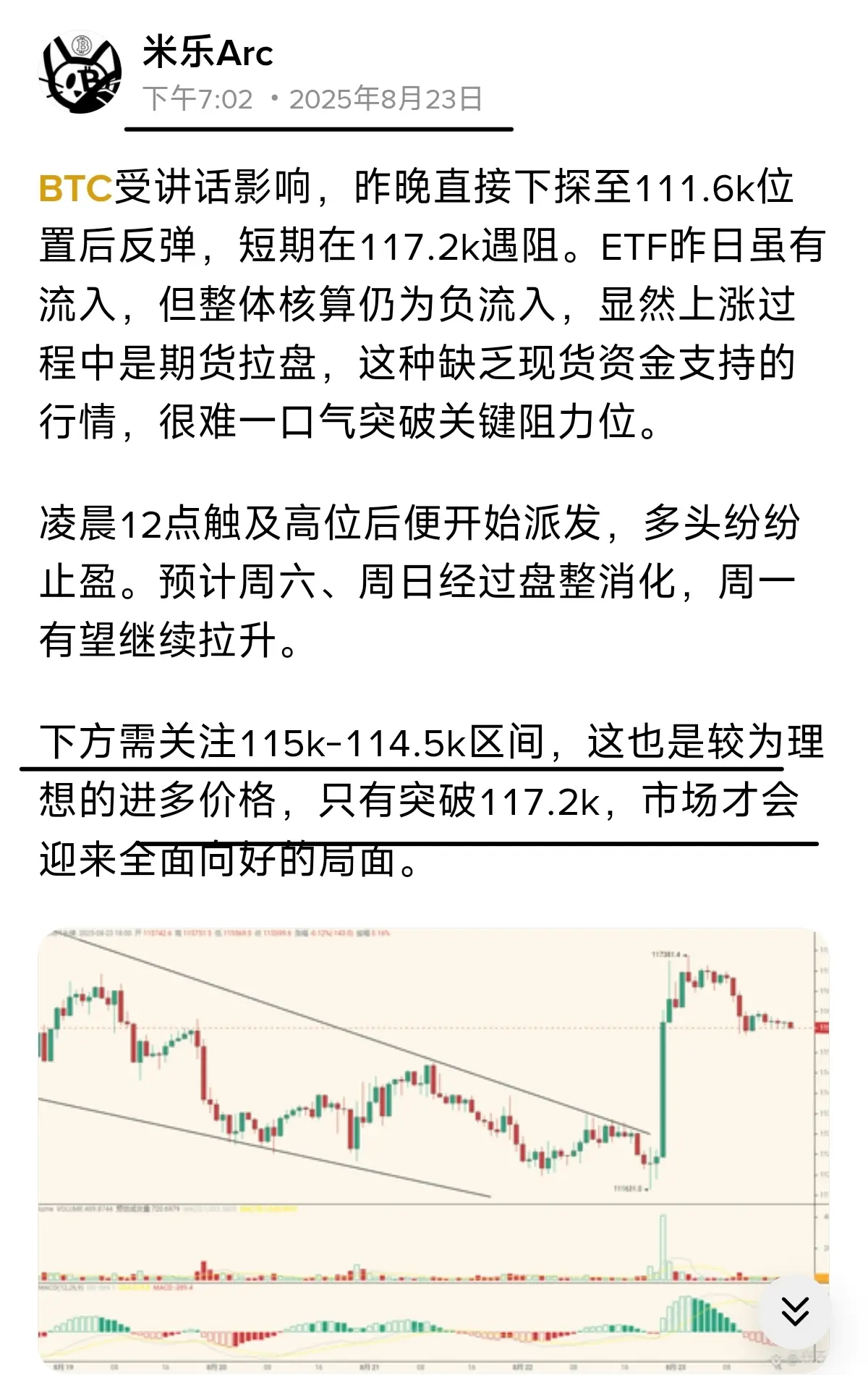

On the 4h level of BTC, the long positions are still weak, while the short positions maintain a moderate release, and the suppression of long positions by short positions continues.

The current liquidity in the futures market is relatively limited. As long as the spot market can maintain the current slight bottom-fishing demand, the subsequent market is likely to stabilize.

However, the weekly downtrend has not changed yet, and it can still be viewed as a pullback market. The overnight rebound to the 111k-111.5k line is a short position, with targets at 110k and 108.5k.

View OriginalThe current liquidity in the futures market is relatively limited. As long as the spot market can maintain the current slight bottom-fishing demand, the subsequent market is likely to stabilize.

However, the weekly downtrend has not changed yet, and it can still be viewed as a pullback market. The overnight rebound to the 111k-111.5k line is a short position, with targets at 110k and 108.5k.

- Reward

- like

- Comment

- Repost

- Share

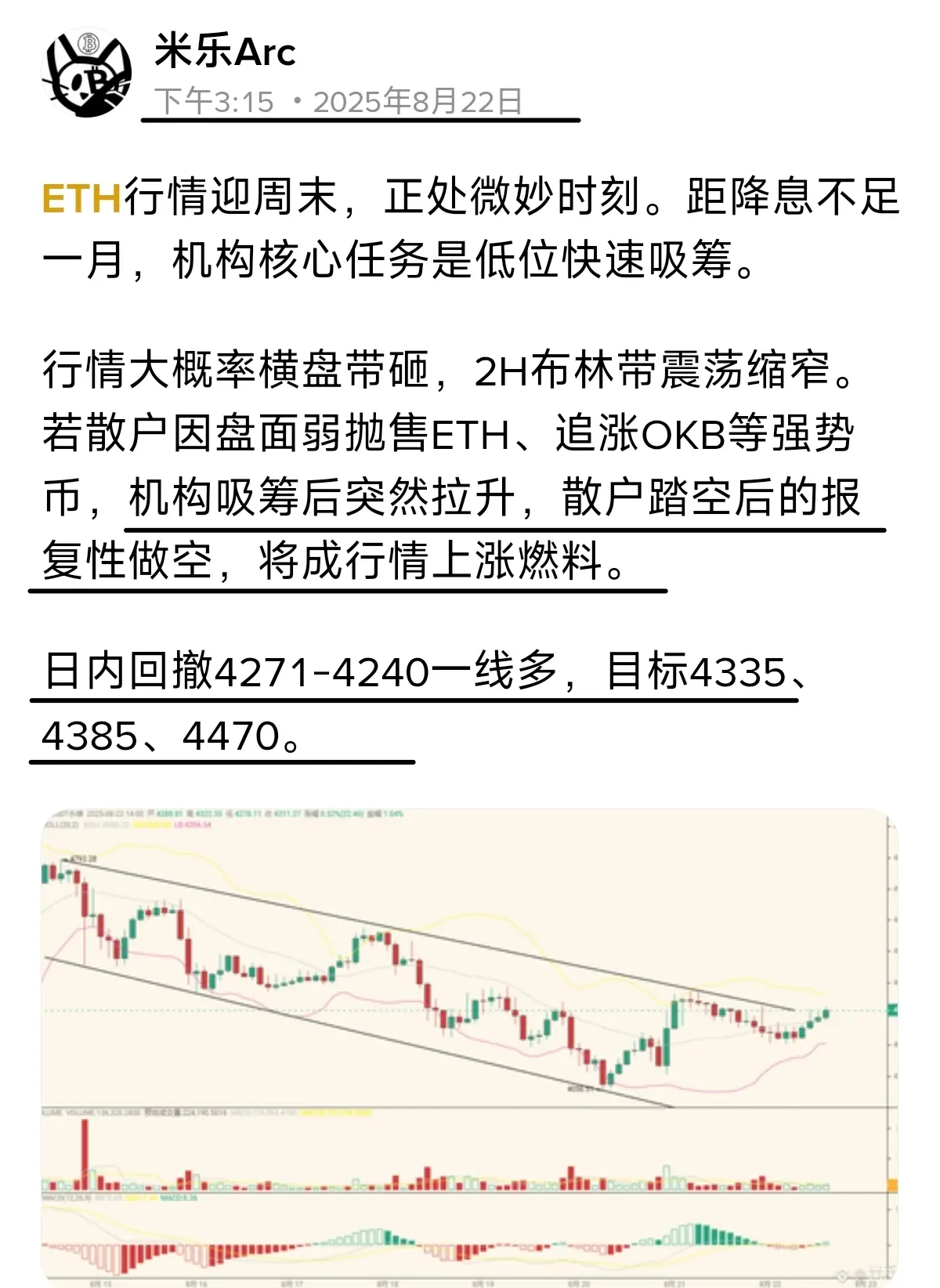

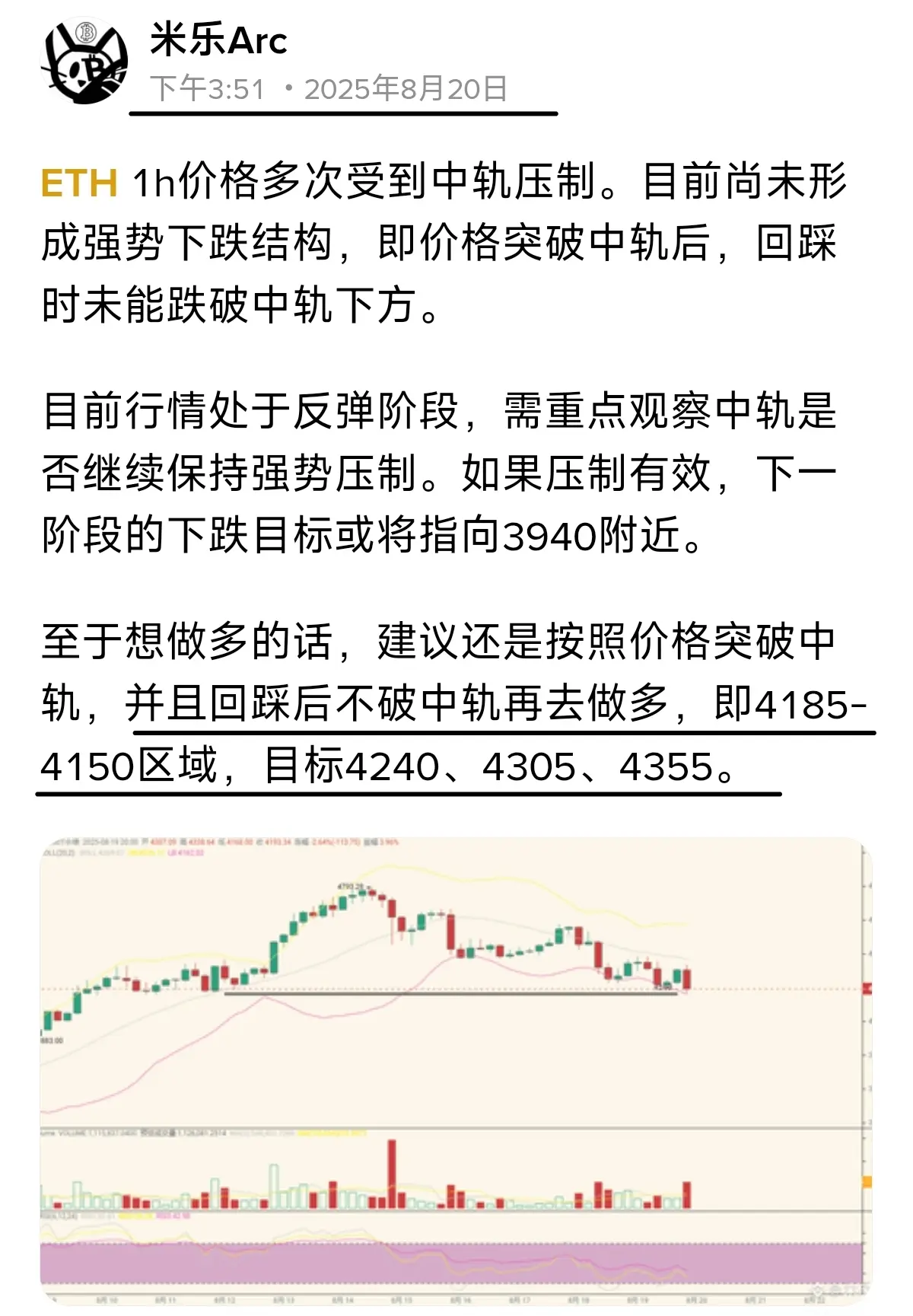

ETH found support in the 4350 area yesterday.

The current maximum upward target can be set at the middle track of the 4-hour BOLL, as the possibility of a subsequent continuation of the decline cannot be ruled out.

It is recommended to short in the range of 4640-4680 during the day, with targets sequentially at 4480, 4350, and 4200.

View OriginalThe current maximum upward target can be set at the middle track of the 4-hour BOLL, as the possibility of a subsequent continuation of the decline cannot be ruled out.

It is recommended to short in the range of 4640-4680 during the day, with targets sequentially at 4480, 4350, and 4200.

- Reward

- like

- Comment

- Repost

- Share

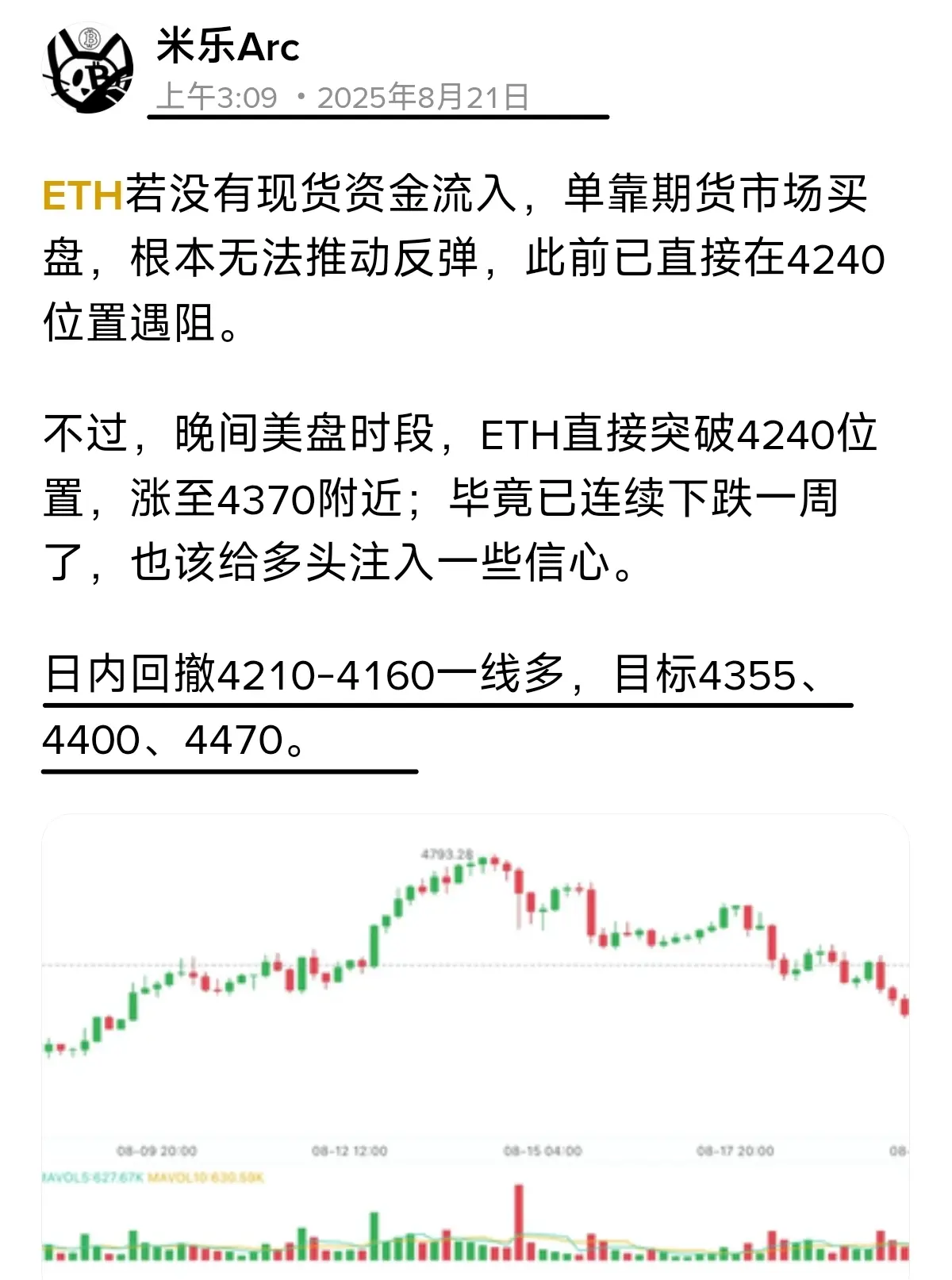

The small-scale trend of BTC is in a series of consecutive falls on the short positions side, but the large-scale has reached support, reflecting on the market data. In the past few days, the hourly and lower levels may have formed a local bottom structure.

As a medium to long-term indicator, the 12H can defend well with its 105k support level, allowing for longer positions. During periods of frequent fluctuations in the market data, it can also participate multiple times in long and short operations. However, if a breakout occurs, one should exit at the first pullback and reserve more lower

View Original

As a medium to long-term indicator, the 12H can defend well with its 105k support level, allowing for longer positions. During periods of frequent fluctuations in the market data, it can also participate multiple times in long and short operations. However, if a breakout occurs, one should exit at the first pullback and reserve more lower

- Reward

- like

- 1

- Repost

- Share

Lionish_Lion :

:

FOLLOW ME to avoid common trading mistakes. Learn what really works from my experience. ⚠️➡️👍 Avoid Losses & Learn Trade easily I believe ETH is still in a bull run. The adjacent BTC is currently just undergoing a Whipsaw; without sufficient oscillation, it is difficult to accumulate enough bearish traders.

It is expected that there won't be much longer to wait, BTC may soon see a rebound, and the subsequent downside potential is very limited.

The current RSI indicator is in an extremely oversold state, which is highly likely to trigger a technical rebound.

Buy on the pullback at 4550-4520 during the night, targets at 4620, 4730, 4830.

View OriginalIt is expected that there won't be much longer to wait, BTC may soon see a rebound, and the subsequent downside potential is very limited.

The current RSI indicator is in an extremely oversold state, which is highly likely to trigger a technical rebound.

Buy on the pullback at 4550-4520 during the night, targets at 4620, 4730, 4830.

- Reward

- like

- Comment

- Repost

- Share

The support at the daily chart level for BTC has been broken, and institutions have abandoned market stabilization, resulting in a noticeable large shark pattern, with the support level looking towards around 108k.

If it can fall to this position, it will be a great opportunity to buy the dip. Holding positions until the end of the year, with the help of 2-3 rate cuts leading to a small bull market, BTC is very likely to reach the 130k-150k range.

Currently, we are looking at a double bottom pattern breakout, while also anticipating a wave of market movement brought by the small shark pattern.

View OriginalIf it can fall to this position, it will be a great opportunity to buy the dip. Holding positions until the end of the year, with the help of 2-3 rate cuts leading to a small bull market, BTC is very likely to reach the 130k-150k range.

Currently, we are looking at a double bottom pattern breakout, while also anticipating a wave of market movement brought by the small shark pattern.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

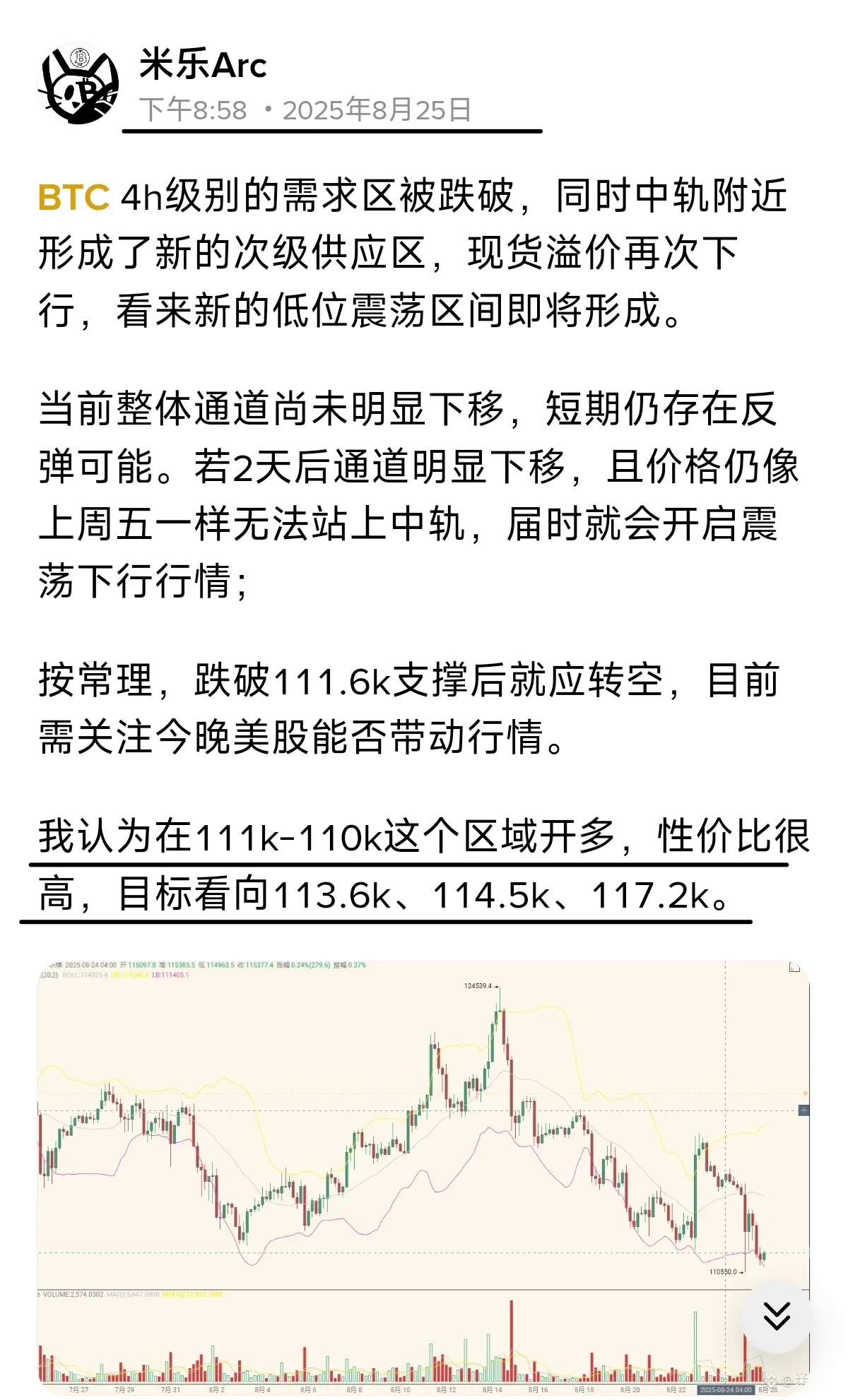

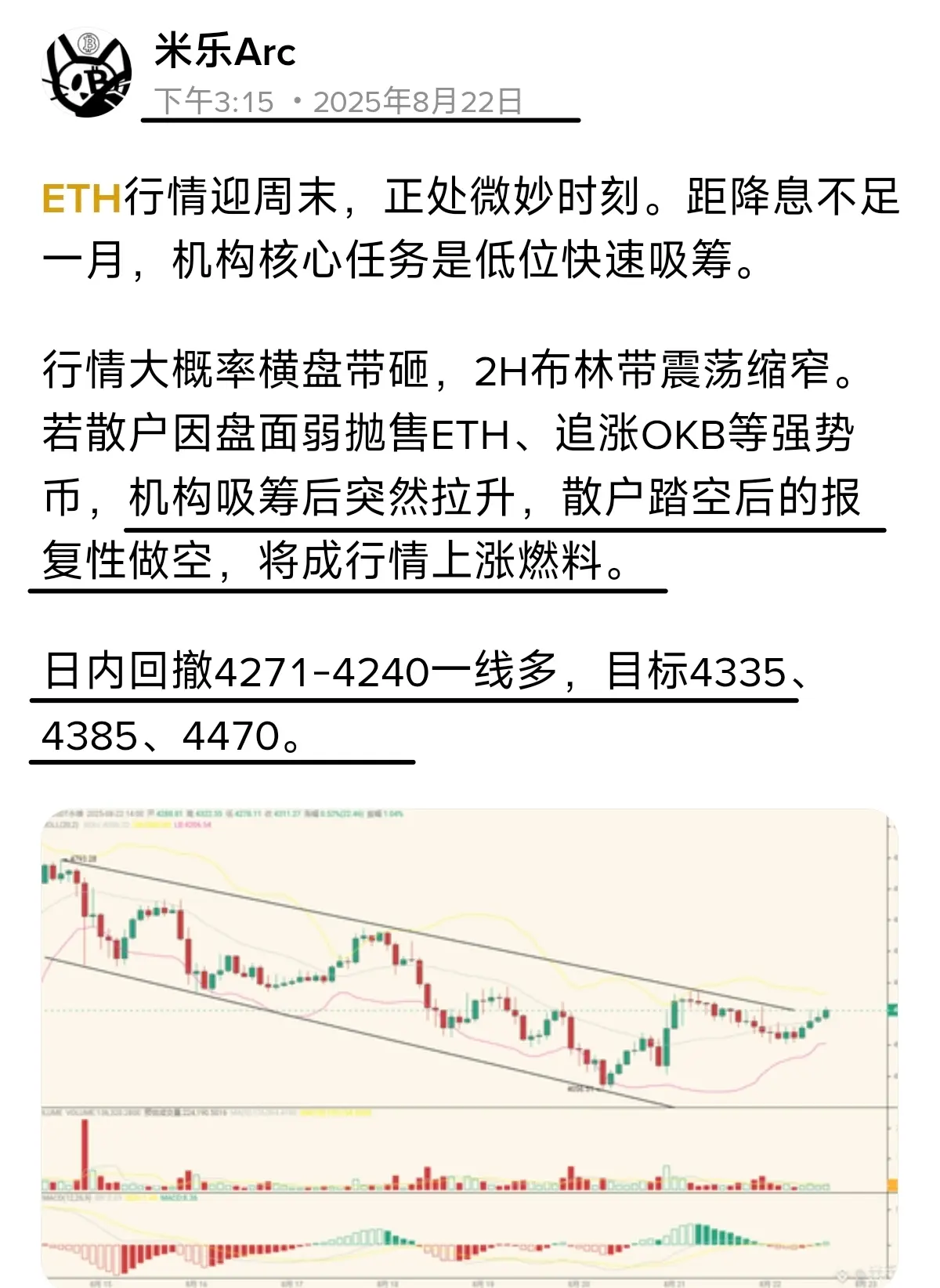

The demand zone on the 4-hour level for BTC has been broken, and a new secondary supply zone has formed near the middle band. The spot premium is declining again, and it seems that a new low volatility range is about to form.

The overall channel has not significantly moved down yet, and there is still a possibility of a rebound in the short term. If the channel significantly moves down in two days and the price is still unable to stay above the middle band like last Friday, then a volatile downward trend will begin.

According to common reasoning, after breaking the 111.6k support, it should tu

View OriginalThe overall channel has not significantly moved down yet, and there is still a possibility of a rebound in the short term. If the channel significantly moves down in two days and the price is still unable to stay above the middle band like last Friday, then a volatile downward trend will begin.

According to common reasoning, after breaking the 111.6k support, it should tu

- Reward

- like

- Comment

- Repost

- Share

What is meant by gold content? You will know by experiencing it yourself!

The decisive signal indicates a bearish trend, entering short positions. The bulls who were so happy just a couple of days ago are completely silenced today!

Perfectly hit our second target! Only take top opportunities, no playing around, let strength do the talking!

View OriginalThe decisive signal indicates a bearish trend, entering short positions. The bulls who were so happy just a couple of days ago are completely silenced today!

Perfectly hit our second target! Only take top opportunities, no playing around, let strength do the talking!

- Reward

- like

- Comment

- Repost

- Share

The layout of Ether space and the head and shoulders pattern don't let you absorb it well, and what was the result? You probably ended up hanging at the mountain top.

Those in authority are confused while bystanders see clearly. Recognizing reality, chasing the market in a downtrend can hit you hard.

View OriginalThose in authority are confused while bystanders see clearly. Recognizing reality, chasing the market in a downtrend can hit you hard.

- Reward

- like

- 1

- Repost

- Share

I_veRealizedThatIt_s :

:

V0 The copied and pasted image, go home and find your mom, stop coming out to play people for suckers.

The BTC weekly MACD death cross has been confirmed, temporarily leaning towards a consolidation adjustment similar to the period from March 24 to August 24.

The current adjustment level has been confirmed to expand, targeting the adjustment of the upward trend since 98.2k. If it falls below the 108k position, the adjustment level will further confirm an expansion to target the adjustment of the upward trend since 74.5k. In other words, the area around 108k is likely to be the support level for the current adjustment.

A rebound during the day to the range of 113.6k-114.3k can be shorted, with t

View OriginalThe current adjustment level has been confirmed to expand, targeting the adjustment of the upward trend since 98.2k. If it falls below the 108k position, the adjustment level will further confirm an expansion to target the adjustment of the upward trend since 74.5k. In other words, the area around 108k is likely to be the support level for the current adjustment.

A rebound during the day to the range of 113.6k-114.3k can be shorted, with t

- Reward

- like

- 1

- Repost

- Share

GateUser-14b5d8ff :

:

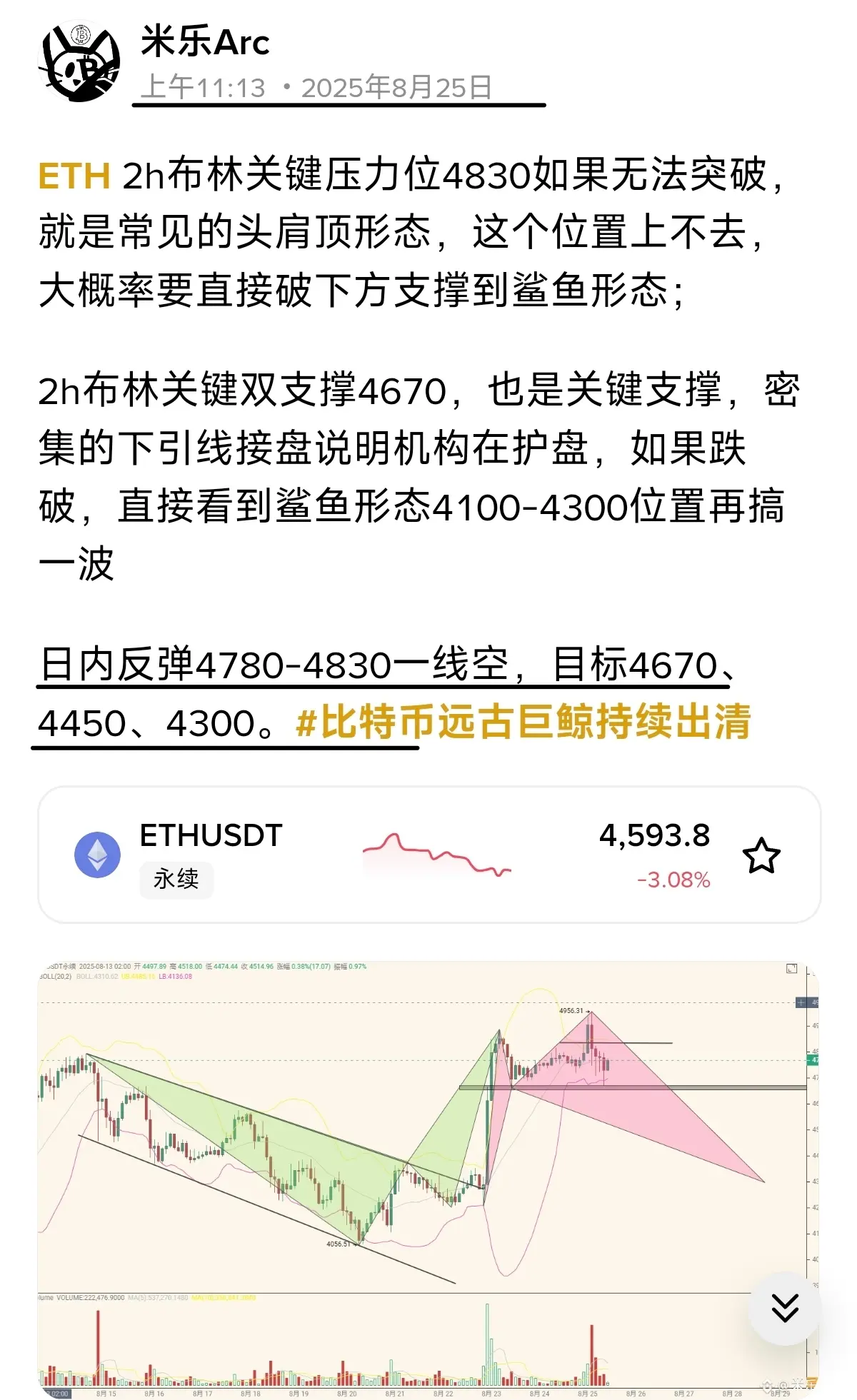

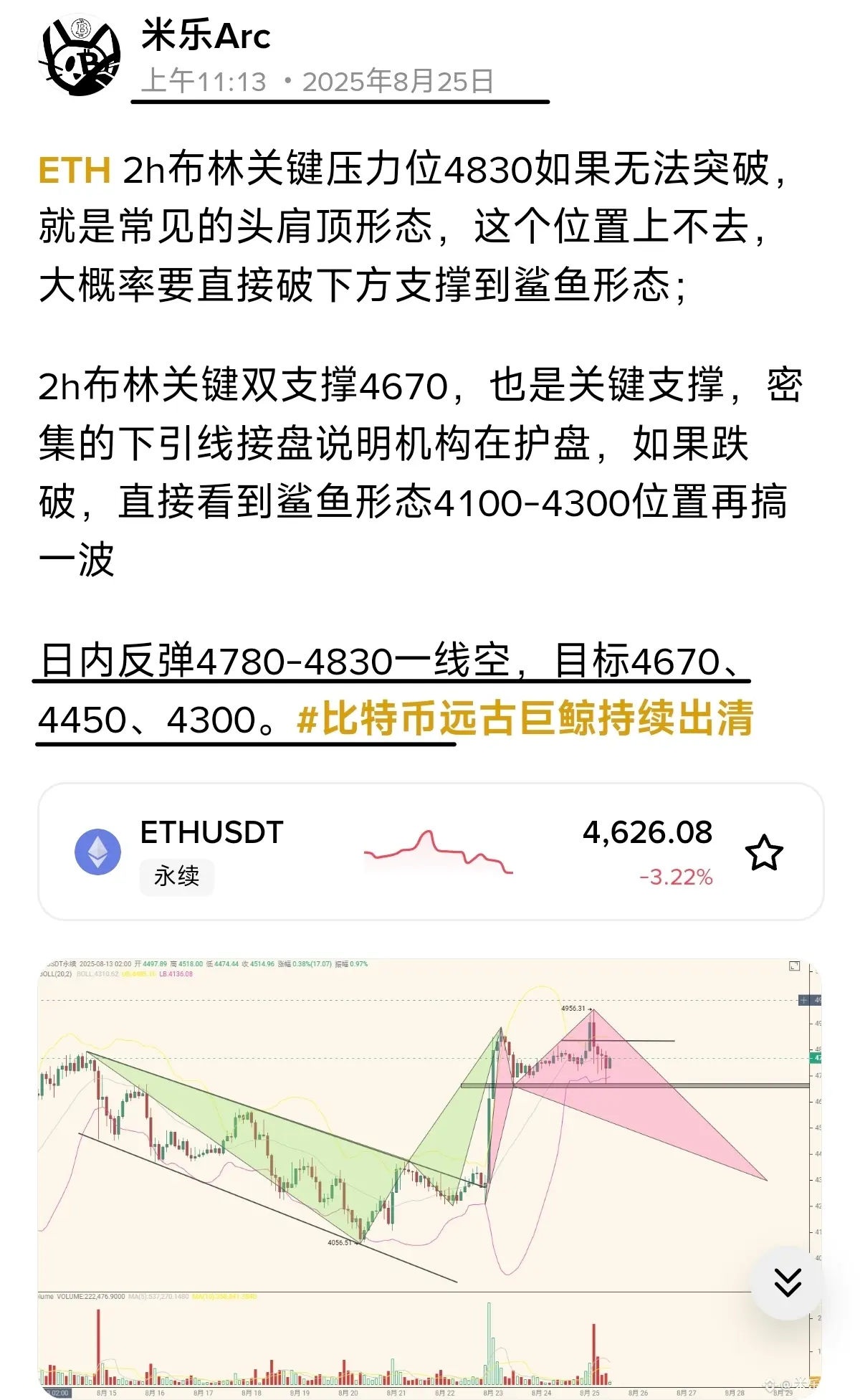

Quick, enter a position! 🚗The critical resistance level for ETH on the 2h Bollinger Bands is 4830. If it cannot break through, it is a common head and shoulders pattern. If it can't go up from this position, it is highly likely to break down to the support level and form a shark pattern.

The 2-hour Bollinger Bands key double support is at 4670, which is also a key support level. The dense lower wicks indicate that institutions are protecting the market. If it breaks down, we will directly see the shark pattern at the 4100-4300 position for another round.

Intraday rebound short at 4780-4830 line, target 4670, 4450, 4300

View OriginalThe 2-hour Bollinger Bands key double support is at 4670, which is also a key support level. The dense lower wicks indicate that institutions are protecting the market. If it breaks down, we will directly see the shark pattern at the 4100-4300 position for another round.

Intraday rebound short at 4780-4830 line, target 4670, 4450, 4300

- Reward

- like

- Comment

- Repost

- Share

Every step of the market movement is on a pre-drawn chessboard, the market maker's actions and the Bull vs Bear Battle are all seen through.

The daily pressure has not been broken, and those who blindly chase long positions can only say they do not understand the truth that "greed comes at a cost."

View OriginalThe daily pressure has not been broken, and those who blindly chase long positions can only say they do not understand the truth that "greed comes at a cost."

- Reward

- like

- Comment

- Repost

- Share

As the saying goes, direction is very important; a thought can lead to heaven or hell. The past couple of days have been reminding to mainly focus on low buys and be careful not to get buried as fuel.

Perfect layout, following my rhythm, isn't it just easy to grasp.

View OriginalPerfect layout, following my rhythm, isn't it just easy to grasp.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share