Post-CPI Market Map — Aug 11 📊🔥

Macro:

CPI came in at 2.8%, below previous — risk assets pop. ETH leads with fresh highs; BTC still in 4H pullback mode.

---

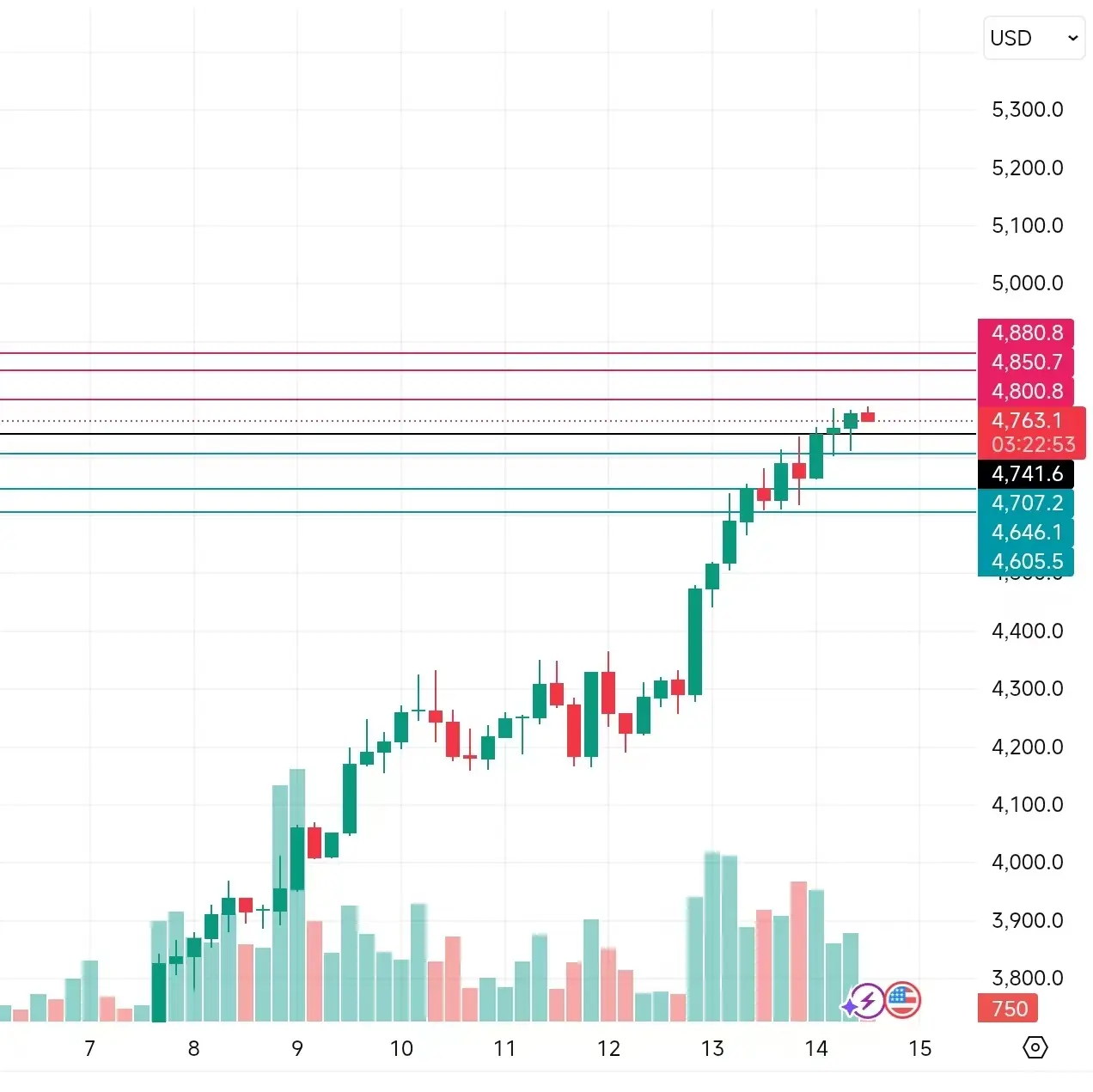

BTC

Key trigger: 4H close > 119,800 → upside to 120,800 → 121,800 → 122,500 (defense at 123,300).

As long as < 119,800, watch 118,800 support; break → 118,000, then spike-risk 116,500 – 115,800 (long zone).

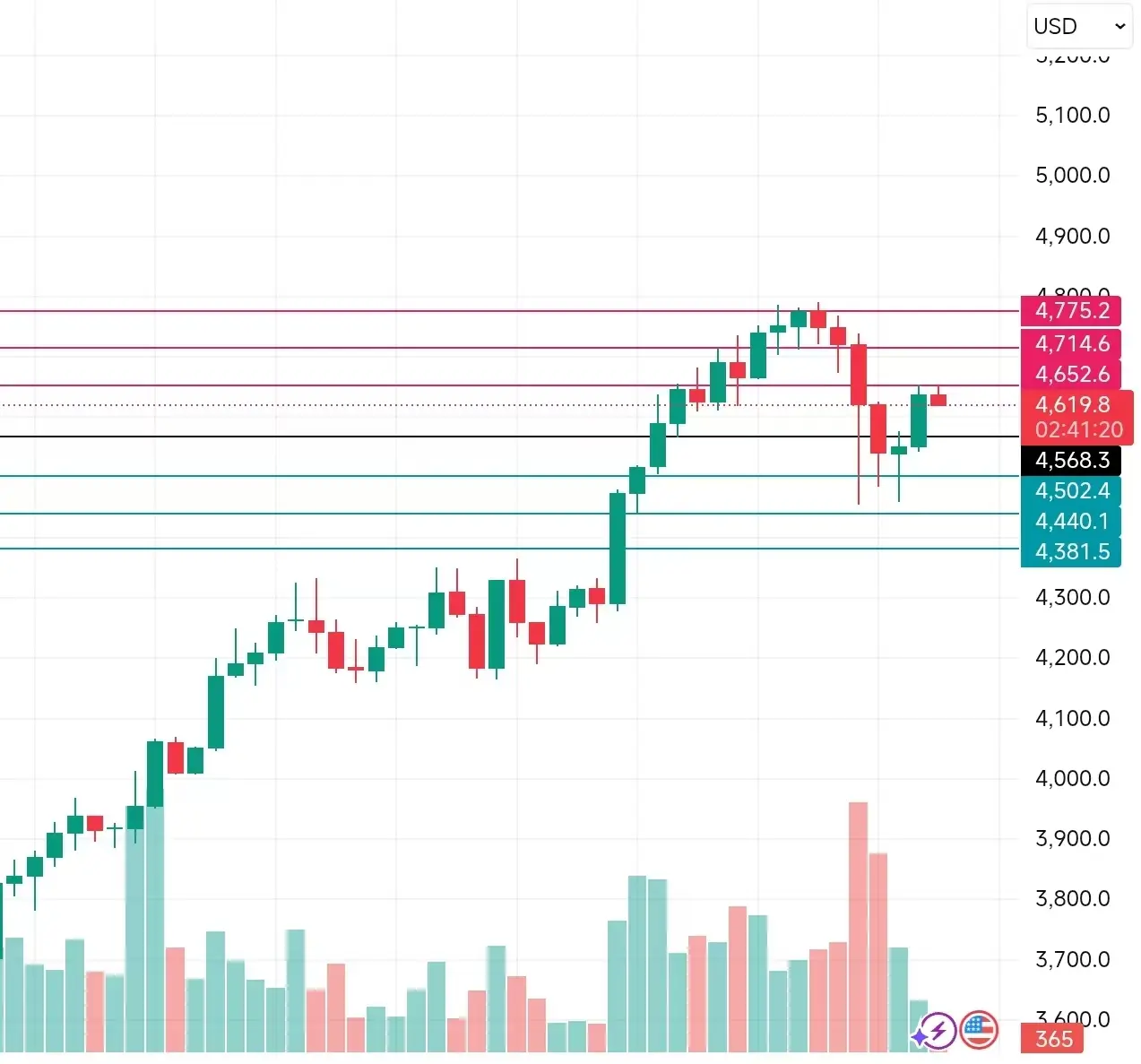

ETH

Strong breakout; resistance 4,500, defense 4,550.

Support: 4,370 → 4,300 — break both to revisit 4,160 base.

Note: Rally is vertical, no healthy pullbacks — trade fatigue risk.

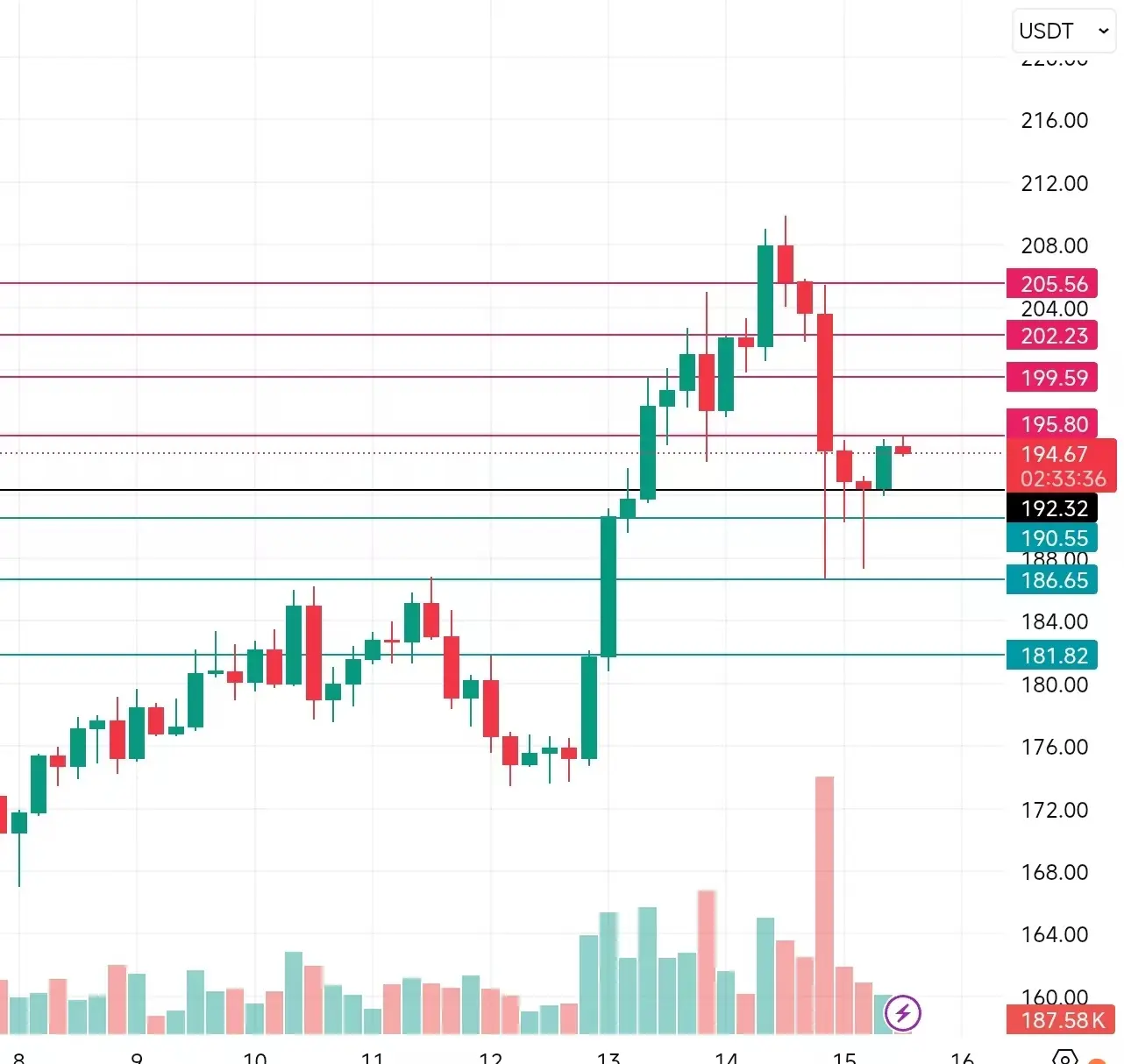

SOL

4H close > 178 → target 186 → 190 → 195.

Drop bac

Macro:

CPI came in at 2.8%, below previous — risk assets pop. ETH leads with fresh highs; BTC still in 4H pullback mode.

---

BTC

Key trigger: 4H close > 119,800 → upside to 120,800 → 121,800 → 122,500 (defense at 123,300).

As long as < 119,800, watch 118,800 support; break → 118,000, then spike-risk 116,500 – 115,800 (long zone).

ETH

Strong breakout; resistance 4,500, defense 4,550.

Support: 4,370 → 4,300 — break both to revisit 4,160 base.

Note: Rally is vertical, no healthy pullbacks — trade fatigue risk.

SOL

4H close > 178 → target 186 → 190 → 195.

Drop bac